Rates Set the Price, Liquidity Sets the Terms. Markets run higher ahead of Fed rate announcement.

Market Update

KEY OBSERVATIONS

Markets push higher: Shifting sentiment and increased expectations for a rate cut in September helped propel small-cap stocks ahead of large-cap during the month.

International markets lead the way: Tariff revisions, a weaker U.S. dollar, and strong local earnings propelled international equities higher.

Yields decline with rate cut likely: Treasury yields fell, core bonds gained, and high yield spreads tightened.

RECAP

Equities moved higher in August, though leadership shifted beneath the surface. The S&P 500 rose 2.0% and remains up 10.8% year-to-date, but the more notable move came from small caps. The Russell 2000 surged 7.1% in August, erasing earlier weakness as investors grew more comfortable with the prospect of Federal Reserve rate cuts. The rotation also showed up at the sector level. Materials and health care were stand-out sectors within the S&P 500, while technology lagged as A.I. enthusiasm gave way to concerns about rising costs and capital intensity.

While the market’s muscle memory to reward growth is still present, August favored value and cyclicals.

Outside the U.S., international equities extended their lead. Developed markets, represented by the MSCI EAFE, advanced 4.3% in August and are now up an outsized 22.8% year-to-date. Japan was a standout, driven by tariff revisions and structural improvements to its economy, while Germany and France trailed the pack. Emerging markets posted a modest 1.3% gain for the month, but remain up 19.0% through the first eight months of the year. Strength in China, supported by targeted policy action, and in Brazil, fueled by strong corporate earnings and attractive valuations, helped offset weaker performance elsewhere.

Fixed income markets also benefited from a shift in tone. Treasury yields fell across the curve after a disappointing unemployment report and dovish messaging out of the Fed’s Jackson Hole summit. Core bonds rose 1.2% in August and high yield added 1.3% with spreads grinding tighter.

Real assets added to the positive momentum. U.S. Real Estate, represented by the FTSE NAREIT REITs Index, gained 3.3% in August as falling rates provided relief. Lodging and resorts led the way, boosted by robust summer travel, while data centers fell behind as investors reassessed capacity and energy usage challenges.

August highlighted the breadth of participation across asset classes. Risk assets pushed higher, credit remained firm, and real assets gained as well. Beneath the headline returns, however, leadership is rotating.

Investors are shifting toward areas tied to policy support, lower valuations, and real cash flow, while the expensive corners of growth trade are being tested. This changing mix is worth watching as markets transition from momentum-driven gains to a backdrop increasingly defined by fundamentals.

THE LIQUIDITY CYCLE BEHIND INTEREST RATES

Liquidity is the invisible force that underpins markets. It facilitates price discovery, supports valuations, and suppresses volatility. When liquidity expands, financial conditions ease even if policy rates are unchanged. When liquidity contracts, fragility emerges. The U.S. financial system is moving through a liquidity cycle that began with extraordinary pandemic-era stimulus. Now, the question is whether the unwind can continue.

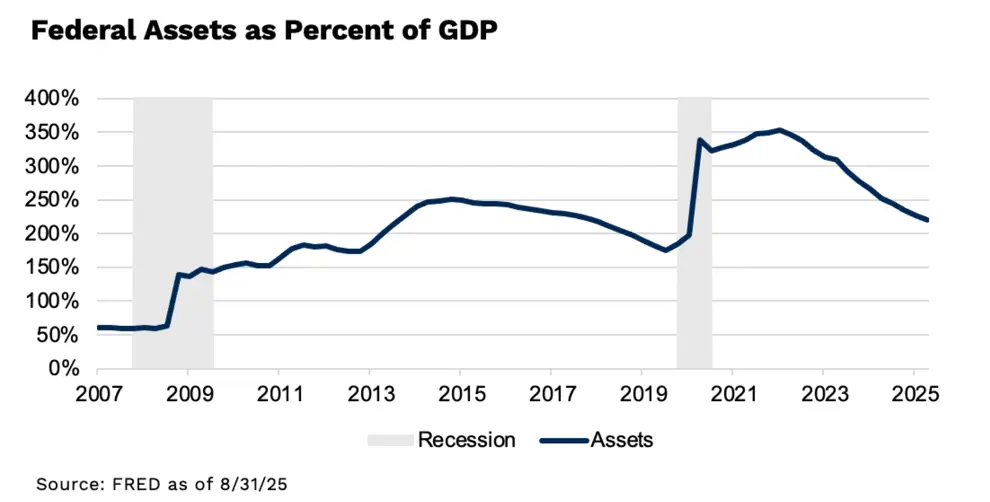

The Federal Reserve remains committed to balance sheet runoff. Quantitative tightening (“QT”) by passive maturity is a slow process. Assets roll off month after month, shrinking reserves on the liability side of the balance sheet.

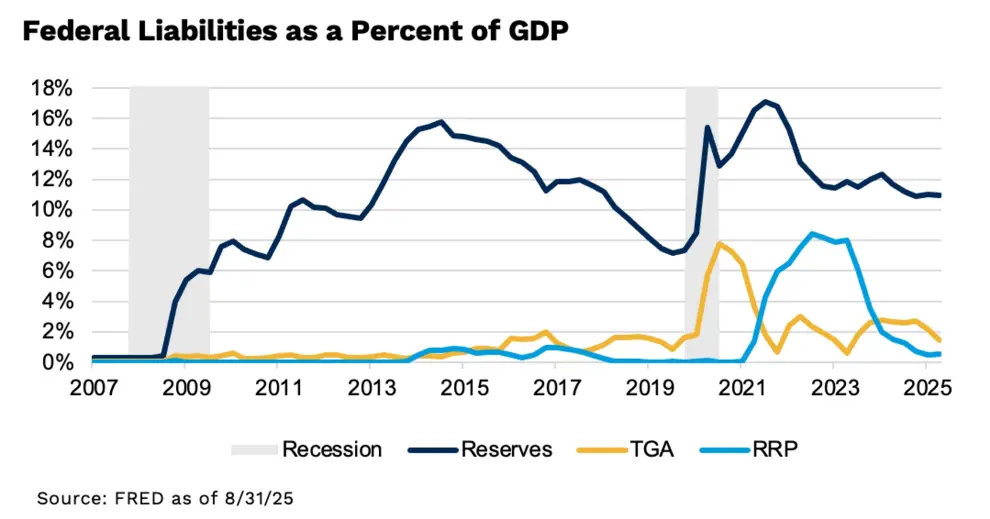

The Reverse Repo Facility (“RRP”) has already absorbed a large portion of excess liquidity during the pandemic. At its peak, RRP held nearly $2.5 trillion of cash seeking collateral. That pool has now been drained, as money markets reallocated to higher yielding treasury bills. At the same time, the Treasury has been rebuilding the Treasury General Account (“TGA”) through issuance to pay maturing assets. Every dollar added to the Treasury’s cash balance is a dollar withdrawn from private sector liquidity.

The next likely source of liquidity to absorb tightening is bank reserves. These have remained elevated relative to history, but the trend is downward. Earlier adjustments have been contained within money markets through facilities like the RRP, but further declines in reserves would shift the impact into the banking system itself.

With the raise of the debt ceiling and increased spending outlined in the “Big Beautiful Bill,” markets must digest not only the Fed’s runoff but also additional Treasury issuance. The implication for the yield curve is likely continued volatility. Thus, the Fed may choose to end QT to avoid over-tightening, an option given balance sheet assets are currently at a pre-pandemic level.

LOOKING AHEAD

The liquidity cycle is likely entering a more constrained phase, though the Fed does have options to manage its position. For investors, the takeaway is clear. Fragility may rise in markets, which would call for durable portfolios through diversification. In this environment, patience and discipline remain essential in navigating a world where broader market forces, not just rates, define the environment.