Calm Above, Currents Below Strong earnings season and resilient economy gives way to a weak July employment report.

Market Update

KEY OBSERVATIONS

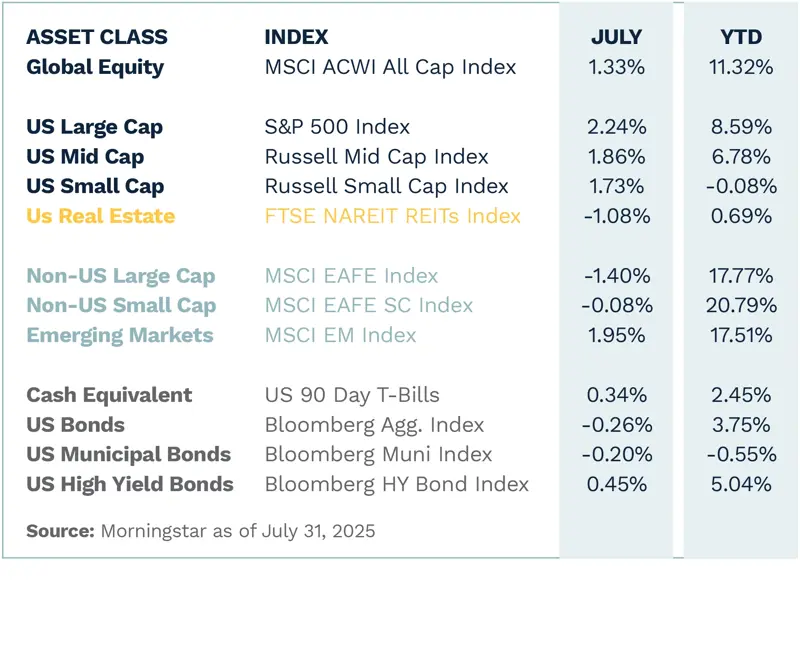

Market Resilience Continues: Markets were mixed in July as equities delivered modest positive returns amidst a favorable earnings backdrop and resilient economic data.

Major Trade Deals Reached: Clarity around trade policy ahead of the August 1 deadline helped give investors a better grasp of what’s to come with key trade deals being made with the EU, U.K. and Japan.

Strong Earnings: Earnings season began with solid fundamentals, but markets remain fragile as misses on expectations were punished and high valuations persist.

Employment Data Surprise: A disappointing July employment report heightened investor uncertainty and future path of interest rate decisions by the Fed.

RECAP

July brought a mix of resilience and recalibration across global markets. Investors navigated a landscape shaped by ever fluent trade policy, ongoing geopolitical tensions and a resilient macro backdrop. Equity markets, for the most part, moved higher, buoyed by a strong start to earnings season and better than expected economic data. Additional clarity on trade policy helped as well, as deals were made with key partners such as the U.K., European Union and Japan before the August 1st deadline.

U.S. GDP grew at 3.0% in the second quarter, driven primarily by consumer spending and a reduction in imports, and the labor market had continued to be resilient until the last week of the month. The S&P 500 Index reached new highs, rising 2.2% to start the second half of the year. Technology and energy sectors were standouts, with the former gaining over 5.0% as AI-driven optimism persisted and the latter benefiting from rising oil prices amidst continued tensions in the Middle East. Small cap equities, as measured by the Russell 2000 Index, modestly lagged their large-cap counterparts, gaining 1.7% in the month. REITs struggled in July. Positive sentiment on the economy was not enough to offset weakness in self-storage, residential and office. Rising rates and a reduced outlook for Fed cuts was a headwind for the asset class.

Non-US Large Cap, as measured by the MSCI EAFE Index, fell -1.4% during the period. Weakness in European markets, particularly Germany and Switzerland, offset modest gains in the UK and Italy. Currency effects weighed on returns, as the U.S. dollar strengthened modestly against major peers. Despite the modest pullback, international equities remain well ahead of domestic year to date. Emerging markets rose 1.9% in July. China was the standout, gaining almost 5%, driven by policy support and improving sentiment around regulation. Broader EM strength was also supported by gains in Korea, though India declined amid ongoing trade uncertainty and an increase in threatened tariffs.

Fixed income markets were mixed as the Bloomberg U.S. Aggregate Bond Index slipped -0.3% in July as investors digested mixed signals from the Federal Reserve. The FOMC held rates steady in July amid persistent inflation and uneven market data. It was not a unanimous decision as there were two dissenting votes, the first time since 1993.

Rates moved higher over the course of the month, driven by lingering inflation concerns, deficit expansion and the markets reduced outlook for recession in the near term. High yield bonds fared better, buoyed by a strong earnings season, a favorable economic backdrop and continued investor appetite for yield. The asset class has now returned approximately 5% year-to-date.

STRONG EARNINGS, HIGH EXPECTATIONS

The second quarter earnings season continues to deliver upside surprises, with broad-based growth and strong beat rates. However, stretched valuations, shifting economic data, and a disproportionate penalty for companies that have missed estimates may suggest we are entering into a more discerning phase. As of August 1st, 66% of S&P 500 companies have reported results for the second quarter. Despite the mixed macro backdrop, 82% of S&P 500 companies have reported a positive earnings surprise and the blended year-over-year growth rate is currently 10.3%. Information technology, communications and consumer discretionary continue to be a standout among sectors, driven by some of the some of the “Magnificent 7” names, while energy was a laggard on the back of falling year-over-year oil prices. Market reaction has been sharp. Companies beating EPS estimates are seeing an average price increase of 0.9% in the two days around the announcement, roughly in-line with the 5-year average. Misses have been punished more severely, with an average decline of -5.6%, worse than recent past, and a prime example of the fragility that persists in markets today.

Fundamentals remain favorable yet valuations remain elevated. The forward 12-month P/E ratio for the S&P 500 hovers near 22x (times) earnings, well above long-term averages. This premium reflects optimism but raises the bar for earnings to continue delivering. So far, the second quarter earnings results are broadly encouraging. Companies are managing costs well and delivering solid earnings growth. However, investors appear more selective, with clear sector divergences and heightened sensitivity to misses. With valuations rich and expectations high, upcoming quarters will require consistent delivery to sustain current market levels.

LOOKING AHEAD

The global economic outlook remains cautiously optimistic. The International Monetary Fund, or “IMF” revised its 2025 global growth forecast slightly higher, citing improved financial conditions and fiscal expansion in key markets. Still, risks remain. Inflation in the U.S. continues to run slightly above target, the recent July employment report was anything but rosy and geopolitical tensions, from the Middle East to trade disputes, could quickly shift market dynamics. In this environment, diversification and discipline remain essential. July’s performance underscored the importance of balancing opportunity with risk, especially as markets evolve into a complex and uncertain investment landscape.