Summer Heatwave. Markets blaze ahead

Market Update

KEY OBSERVATIONS

Markets Advance in June: Despite geopolitical tensions and mixed policy signals, stocks powered higher with technology and industrials leading performance while small caps lagged.

International Leads the Year: Robust local performance and a weakening U.S. dollar has buoyed returns in markets abroad.

When Uncertainty is High, Context is Grounding: Recent price moves may cause investors concern, but additional context may provide perspective on the weaker U.S. dollar and rising oil prices in June.

Big Bill, Big Deficit: According to the Congressional Budget Office, the “Big Beautiful Bill” will increase the deficit by more than $2 trillion over the next ten years. Expanding fiscal spending in a growing economy raises questions about long-term debt sustainability and funding sensitivity.

RECAP

Markets gained ground in June, extending the year’s mostly positive performance despite geopolitical uncertainty and evolving policy signals. Volatility surfaced briefly following Middle East tensions, but sentiment stabilized quickly and showed evidence of investor resilience in the face of ongoing global uncertainty.

Investor muscle-memory kicked in, and, once again, technology stocks, and AI-centric constituents of the “Magnificent Seven,” ticked higher.

The sector climbed an impressive +9.8%, once again making it the biggest gainer for the month. On the other hand, industrial stocks have quietly emerged as a top-performing sector this year, up +12.7%. That strength appears tied to investor optimism around pro-manufacturing policy goals from the current administration. Small caps struggled during the first half of the year with the biotech sector declining on anticipated scrutiny from U.S. policy and inflationary pressures.

The S&P 500 outpaced the MSCI EAFE by +2.9% and lagged the MSCI EM by -0.9% for the month. Year-to-date, international exposures remain ahead, supported by robust local market performance and a weaker U.S. dollar, which has enhanced returns.

Treasury yields declined across the curve in June. The 2-year yield ended the month at 3.7%, as markets priced in a higher likelihood of near-term Fed easing in response to softer growth data and a weaker-than-expected inflation print. Credit spreads also tightened, supported by steady demand and a favorable risk backdrop despite mixed economic signals.

WHEN UNCERTAINTY IS HIGH, CONTEXT IS GROUNDING

In a market environment that often reacts faster than it reflects, uncertainty is an almost constant companion. Today, that uncertainty is elevated, and understandably so. Fiscal dynamics are rapidly shifting, inflation is caught between opposing forces, and policy is in flux. It is a time that calls for clarity, not certainty. And when clarity is hard to come by, context becomes our foundation.

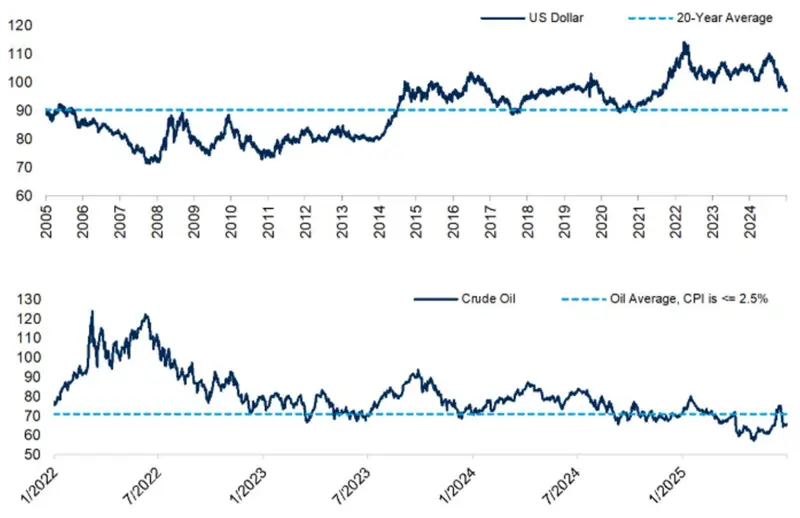

Much has been made of recent U.S. dollar weakness and grumblings of the potential for the U.S. losing its reserve currency status (a topic for another day). Similarly, with rising tensions in the Middle East, oil has moved upward over the month adding to inflation concerns. At first glance investors may have concern, but with a bit of context that concern may abate.

If we were to rephrase “U.S. dollar weakens -11% year-to-date” to “U.S. dollar retraces back to 2022 levels, remains over 7% above the 20-year average” it may elicit different levels of concern. Or, if we mention that oil is below average historical levels where inflation was around 2.5%, that may also elicit different levels of concern. Context matters.

LOOKING AHEAD

The dollar is weakening. The deficit is growing. The yield curve is steepening and rates remain elevated. These signals are not pointing in one direction, but they are flashing that the market is uncertain and deeply sensitive to fiscal and monetary decisions. Our process is not about predicting every market twist, but rather, aligning investment positioning with the underlying incentives that shape policy, capital flows, and investment behavior. When uncertainty is high, context is grounding. And context today tells us that even with policy rates likely to fall at some point, the path there may not be smooth, especially if the market starts asking harder questions.