Imperfect Independence. A brief review of Fed Independence.

Market Update

KEY OBSERVATIONS

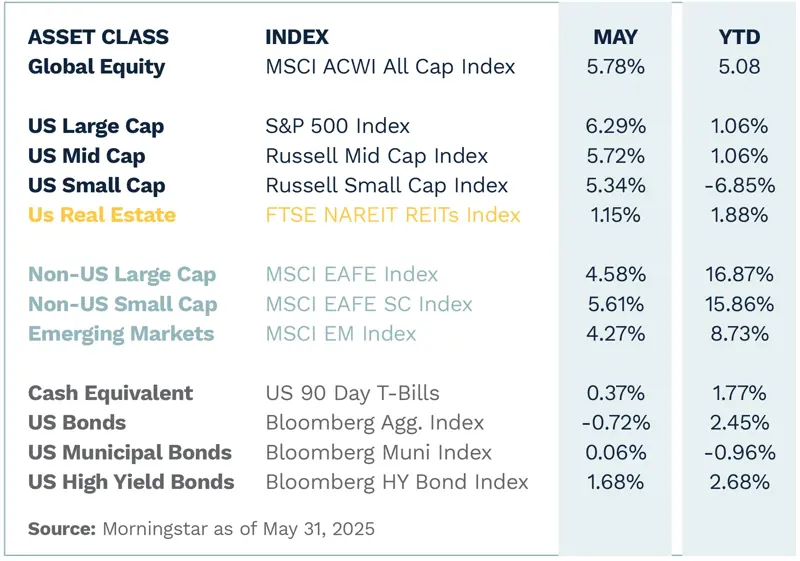

Markets Warm with the Weather: May brought a more constructive tone as trade tensions eased, lifting sentiment and encouraging a rebound in risk assets.

Fixed Income Buyers Remain Cold: While equities priced in potential fiscal stimulus, bond markets focused on long-term deficit risks, pushing yields higher across most of the curve.

Fed Independence Under the Spotlight: The Fed has held rates steady this year while calls from the Executive Branch grow louder to ease policy. Investors wonder yet again how independent the Fed truly remains.

Fed Structure Limits Political Control: Fed governors serve staggered 14-year terms and require Senate confirmation, but average tenure is only about seven years. While this structure gives presidents some influence, it falls short of control. This is especially true given that the full voting Federal Open Market Committee (FOMC) includes five regional presidents unaffiliated with the Executive Branch.

Imperfect Independence: Despite renewed debate around Fed leadership and independence, there is no current evidence to suggest investors should shift positioning. The Fed remains an imperfect yet vital anchor for monetary stability.

RECAP

May brought a welcome change in tone, both in the weather and the markets, as the warmth of spring settled across North America. The initial jolt from April’s tariff announcements faded into more tempered discussions and signs of de-escalation. Investors responded in kind, especially in the growth-oriented corners of the market. Technology stocks, once again led by the “Magnificent Seven,” surged ahead. In May, the sector climbed an impressive +10.9%, making it the only sector to notch double-digit gains and distinguishing it as the clear winner of the month. Not all sectors shared in the rally.

Healthcare, in contrast, struggled under the weight of renewed political scrutiny. Concerns over drug pricing rhetoric and uncertainties tied to pending tax legislation dragged the sector down -5.5%, making it the only U.S. sector to post a decline for the month.

Optimism was most concentrated in U.S. markets which helped them pull ahead of their Non-U.S. peers. The S&P 500 outpaced the MSCI EAFE and MSCI EM by +1.71% and +2.02%, respectively, for the month. Still, allocations outside the U.S. remain in the lead year-to-date, bolstered by solid local market returns and a weak U.S. dollar year-to-date.

Not all investors were comforted by the easing of trade tensions. Bond markets responded more cautiously. While equities leaned into the possibility of new fiscal stimulus, fixed income investors focused on the long-term implications for the federal deficit. Yields rose across most of the curve, except at the short end, as the Federal Reserve kept rates unchanged and signaled its ongoing inflation vigilance. The backdrop for bondholders remains complex, shaped by policy uncertainty, legal challenges to tariff plans and the broader fiscal outlook.

To that end, May marked the one-year countdown for Federal Reserve Chair Jerome Powell’s term as chair, which will end in 2026. While his seat on the Board of Governors ends in 2028, the question of leadership, and by extension Fed independence, is back in the spotlight. Add to this the open interest from President Trump for lower rates and investors are again asking: how insulated is the Fed from political pressure, really?

WHAT’S AT STAKE

Fed independence is not about optics or tradition. It is foundational to stable prices and economic growth. When it falters, the fallout is real. History shows us that political interference in monetary policy can fuel inflation, destabilize asset prices and increase the cost of capital. The risk is not a theoretical concern; it is existential for allocators. If investors lose confidence in the Fed’s impartiality, global demand for U.S. Treasuries could soften and the margin of safety that underpins valuations across all asset classes, from growth stocks to municipal bonds, could erode.

LOOKING AHEAD

The Fed is not infallible, but its design and legal safeguards meaningfully limit short-term political influence. That is not just a procedural win; it offers a structural advantage for long-term investors. Economic policy that bends to election cycles tends to deliver short-lived gains and long-term consequences.

As the market begins to price in potential leadership transitions and shifting policy postures, long-term allocators would do well to focus elsewhere. Structural drivers like fiscal policy, entitlement spending and the trajectory of U.S. deficits are far more likely to influence Treasury yields and capital markets than the next one or two Fed appointments.

Fed independence deserves attention, especially when headlines blur the lines between politics and policy. But perspective matters: history and institutional design suggest that the Fed remains an imperfect but resilient anchor of monetary stability. For now, we see no evidence that warrants a change in positioning based on this issue alone.