First Quarter 2024 - Quarterly Market Update

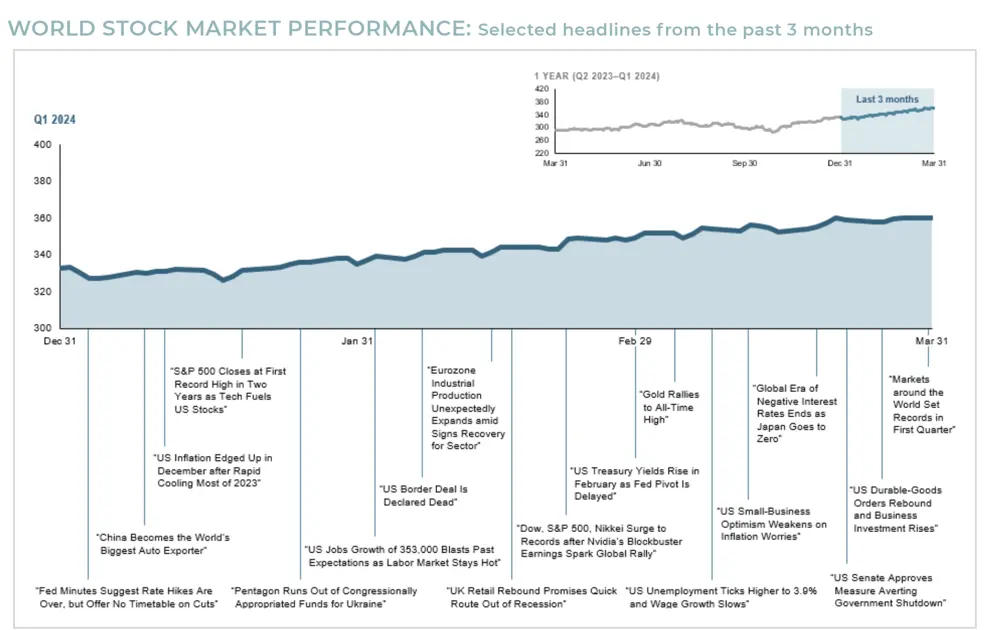

Defying investor expectations, the U.S. economy continues to be defined by one word: resilient. U.S. GDP has grown above 2% in each of the last six quarters and the labor market remains strong. Against this healthy economic backdrop, the equity market and “riskier” segments of fixed income pushed higher during the first quarter. Valuations have moved higher on the back of strong price movement while earnings growth has been muted. Expectations are for positive earnings growth in Q1 (3.6%) and for calendar year 2024 (11.0%) but margin pressures may be a headwind.

Inflation moderated during the quarter but remains above the Federal Reserve’s 2% target. The housing/rent component of the inflation index has been a major reason inflation has not moved lower more quickly, and the path to 2% from here may not be linear.

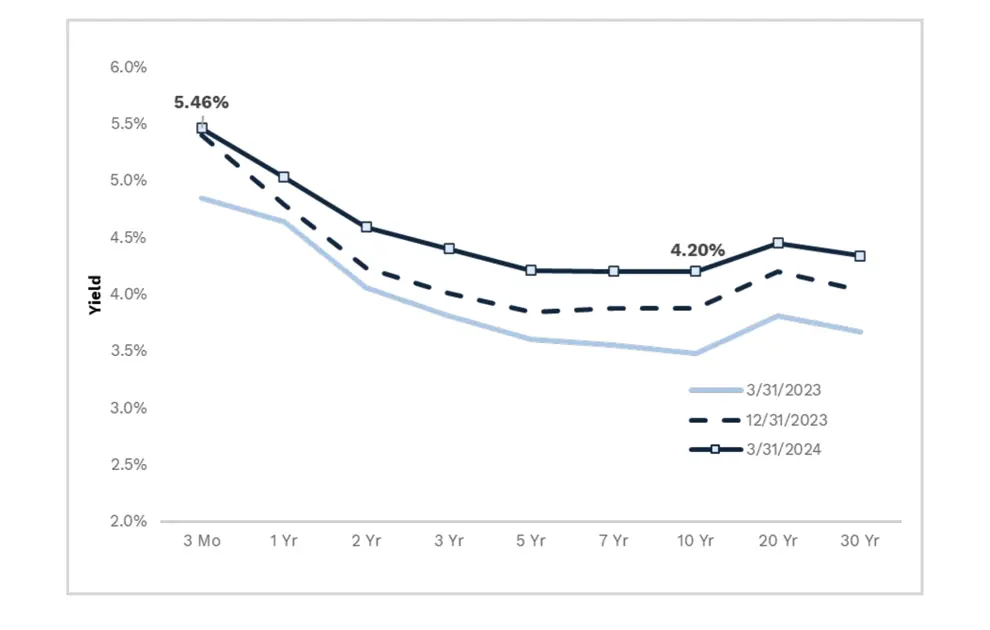

Expectations for Federal Reserve rate cuts shifted significantly in the first quarter. Entering 2024, the market was pricing in at least six rate cuts by the end of the year, but sentiment shifted quickly to only three by the time the quarter finished. Interest rates moved higher across the yield curve placing significant downward pressure on traditional fixed income markets.

EQUITY

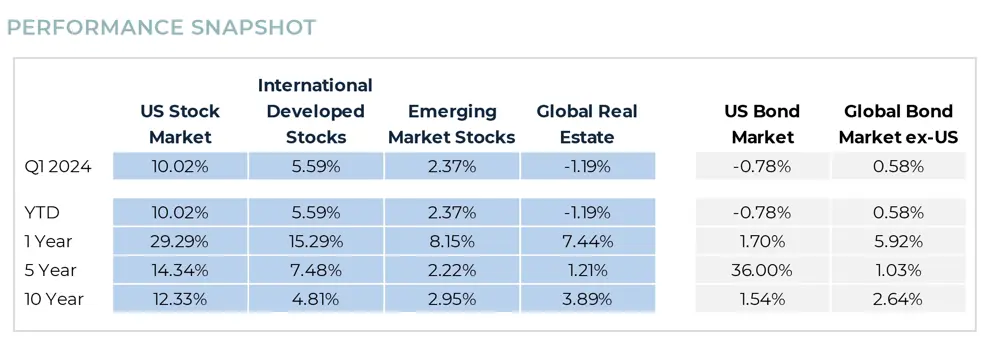

Domestic equity markets had favorable results during Q1 2024, with large cap outpacing small cap and growth besting value. The S&P 500 Index touched new highs and had its best start to a year since 2019, returning 10.6%. Concentrated leadership within the large cap index remains, with four constituents (Nvidia, Meta, Microsoft, and Amazon) accounting for nearly ½ of the index’s gain. U.S. small cap stocks, as measured by the Russell 2000 Index, also produced a positive quarter, up 5.2%.

Non-U.S. equity markets also had positive returns in the first quarter. Developed markets benefited from strong results in Japan and softening inflation in Europe; the MSCI EAFE Index gained 5.8%. Stabilizing economic growth in Japan, corporate governance reform and a declining yen were tailwinds for the country. Growth in the UK markets came despite reports their economy had entered a recession for the first time since early 2020. Emerging economies, as measured by the MSCI Emerging Markets Index, trailed developed markets, returning 2.4%. China continues to underwhelm as economic growth remains anemic and uncertainty around the real estate market persists.

Rising interest rates were a headwind for real estate investment trusts (or “REITs”) with the benchmark FTSE NAREIT Equity REITs Index falling 0.2%. The AI craze was a tailwind for the data center sub-sector while self-storage and diversified realty were notable areas of weakness.

FIXED INCOME

Shifting expectations of when the Federal Reserve will begin to cut interest rates was the main driver of the move higher in interest rates during the quarter and, as a result, the Bloomberg U.S. Aggregate Bond Index lost 0.8% to begin the year. The U.S. Treasury curve steepened (10 year-2 year spread) but remains inverted. Fixed income yields remain attractive across most sectors.

Corporate fundamentals remain favorable, helping to propel riskier segments of the fixed income market, such as high yield, past comparable government bonds.

Index performance is provided as a benchmark. It is not illustrative of any particular investment. An investment cannot be made in an index. Past performance is not an indication of future results. Russell 3000 Index, MSCI World ex USA Index, MSCI Emerging Markets Index, S&P Global REIT Index, Bloomberg Aggregate Bond Index and Bloomberg Global Aggregate Bond Index ex-US. Returns as of 3/31/2024.

These headlines are not offered to explain market returns. Instead, they serve as a reminder that investors should view daily events from a long-term perspective and avoid making investment decisions based solely on the news.