First Quarter 2025 - Quarterly Market Update

Markets shifted tone and investors grew more anxious of the current economic environment as foreign trade policy took hold with the Trump administration’s announcement of a 10% universal tariff and additional tariffs on various countries. Consumer confidence fell, touching levels last seen in 2021, as the risk of recession grew and inflation remains elevated.

Recent economic projections suggest the Fed may be comfortable maintaining their current restrictive policy stance running counter to the current administration’s hopes. Non-U.S. equities outpaced domestic by a substantial margin during the first quarter as fragile markets began to crack. The MSCI EAFE Index beat the S&P 500 by the widest margin since Q2 2002. Non-U.S. benefited from easing policy in Europe, increased defense spending and renewed economic policy efforts in China, while growing uncertainty on the economic outlook hindered markets in the U.S.

EQUITY

U.S. equity markets came under pressure in the quarter. The S&P 500 fell 4.3% while the Russell 2000 declined 9.5%. Evolving trade policy (i.e., tariffs) and other government actions drove uncertainty and reduced optimism. Elevated valuations and heavy index concentration laid the groundwork for heightened market volatility. Despite 61% of underlying constituents in the S&P 500 beating the index, the “Magnificent 7” dragged down the benchmark as six of the stocks fell double digits. It was a strong quarter for non-U.S. markets with both MSCI EAFE and MSCI Emerging Markets advancing 6.9% and 2.9%, respectively. Europe was particularly strong, posting a double-digit return, benefiting from comparatively stable economic policies. China, Brazil and Mexico helped propel emerging markets.

Strength in China was supported by favorable manufacturing data and optimism around President Xi’s policy efforts. Real Estate, or REITs, generated a positive return, benefitting from the declining interest rate environment. More defensive areas, such as health care and infrastructure, outperformed. Data centers took a step back during the period in sympathy to the AI sell-off.

FIXED INCOME

Fixed income markets were positive as interest rates declined during the quarter. Growing concerns regarding the U.S. economy pushed investors to seek “safe haven” assets, fueling the move lower in rates. The Bloomberg U.S. Agg Bond Index returned 2.8% during the quarter. The Federal Reserve held rates steady at both the January and March meetings, maintaining a restrictive policy stance. Longer duration bonds, core fixed income, and inflation protected bonds fared best.

Index performance is provided as a benchmark. It is not illustrative of any particular investment. An investment cannot be made in an index. Past performance is not an indication of future results. Russell 3000 Index, MSCI World ex USA Index, MSCI Emerging Markets Index, S&P Global REIT Index, Bloomberg Aggregate Bond Index and Bloomberg Global Aggregate Bond Index ex-US. Returns as of 3/31/2025.

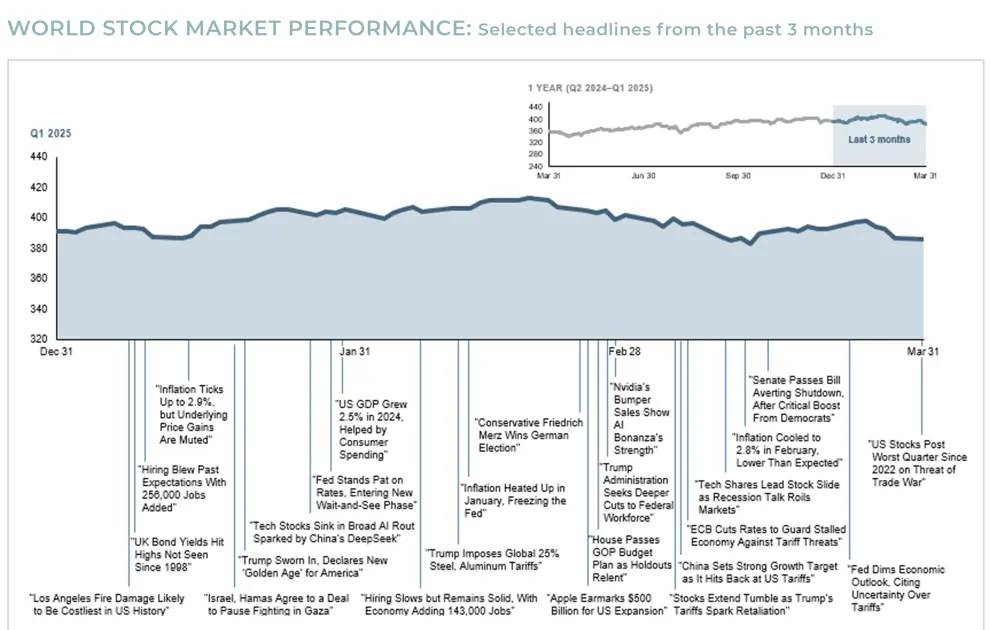

These headlines are not offered to explain market returns. Instead, they serve as a reminder that investors should view daily events from a long-term perspective and avoid making investment decisions based solely on the news.