Fourth Quarter 2024 - Quarterly Market Update

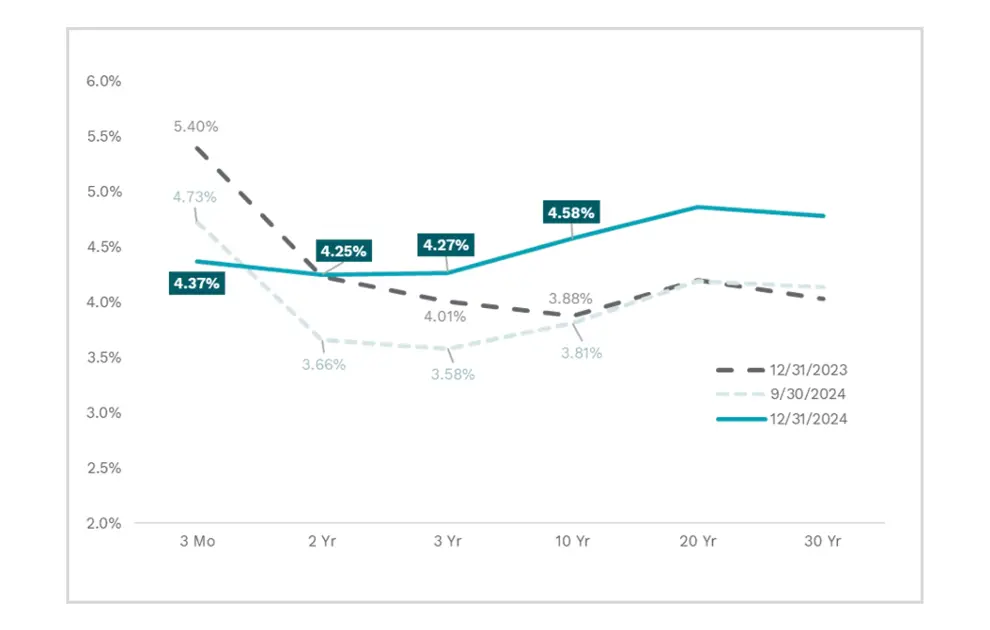

The Federal Reserve’s decision to cut rates by another 50 basis points (or 0.50%) was a key event in the quarter, leading to a mixed reaction across investment markets. The 10-year U.S. Treasury yield soared by over 75 basis points, indicating resistance from the bond market due to concerns of more persistent inflation and uncertainty around the impact of potential policy changes.

After another positive quarter for U.S. equity markets and a strong 2024, market concentration has continued to grow and so have the risks associated with it. It has historically been difficult for companies to sustain high levels of growth over the long-term, with less than 10% of companies being able to sustain 20% sales growth for more than five years. Even a small reversion of these “Magnificent 7” stocks (which accounted for over 50% of the S&P 500’s return in 2024) may lead to higher volatility in the future. Full valuations, concentrated U.S. large-cap indexes, the risk of reigniting inflation and a new administration are shaping investor sentiment as we move into the New Year.

EQUITY

U.S. equities ended the year with modest positive returns in the fourth quarter despite elevated volatility. The S&P 500 returned 2.4% for the quarter, ending the year 25% higher than it began and the first time since 1998 that the index finished back-to-back years above 20%. Strong performance in the technology, communications, and consumer discretionary sectors helped drive results. That said, narrow market leadership means that the fortunes of a handful of companies disproportionately influence the broader market. Any misstep, be it a disappointing earnings report or adverse development, could lead to significant volatility. Non-U.S. equity markets, represented by the MSCI EAFE Index, took a large step back, falling -8.1% amid signs of economic weakness, concerns over potential tariffs, and geopolitical uncertainty. Emerging markets also struggled, with the MSCI Emerging Markets Index falling -8.0%. A stronger dollar and a growing pro-U.S. narrative produced formidable headwinds for Chinese equities. That said, China, the largest country in the benchmark, did grow 19.4% for the year as officials pledged “more proactive” fiscal measures and “moderately” looser monetary policy going forward.

Rising interest rates were a significant headwind for REITs in the fourth quarter. The FTSE NAREIT Equity REITS Index declined -8.2%, with industrial and self-storage sectors underperforming due to slowing manufacturing and post-pandemic occupancy issues.

FIXED INCOME

Fixed income markets broadly struggled during the period, despite the Federal Reserve’s rate cut efforts. The Bloomberg U.S. Aggregate Bond Index fell -3.1% for the quarter and only 1.3% for the year. The resilient economy and concerns about persistent inflation pushed interest rates higher with the 10-year Treasury yield rising 77 basis points. Much of the weakness occurred in December following a more hawkish-than-expected monetary policy meeting, with plans to “proceed cautiously” on rate actions going forward. Of note, the yield curve did normalize during the period with the yield on the 10-year bond moving above that of its 2-year counterpart for the first time in years. This was a welcome development for investors as an inverted yield curve has historically preceded a recession.

Index performance is provided as a benchmark. It is not illustrative of any particular investment. An investment cannot be made in an index. Past performance is not an indication of future results. Russell 3000 Index, MSCI World ex USA Index, MSCI Emerging Markets Index, S&P Global REIT Index, Bloomberg Aggregate Bond Index and Bloomberg Global Aggregate Bond Index ex-US. Returns as of 12/31/2024.

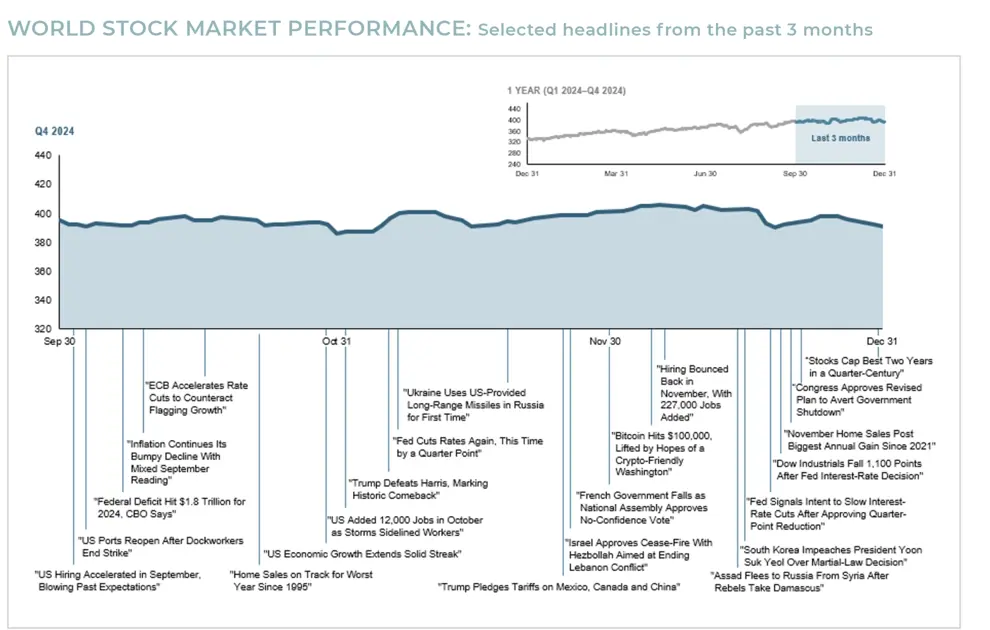

These headlines are not offered to explain market returns. Instead, they serve as a reminder that investors should view daily events from a long-term perspective and avoid making investment decisions based solely on the news.