Second Quarter 2024 - Quarterly Market Update

Growth remains positive and core inflation moderated from 3.8% to 3.3% during the quarter. The current market environment has provided room for the Federal Reserve to reduce the Fed Funds rate. This sentiment fueled the equity market and “riskier” segments of fixed income, such as high yield. Valuations have moved higher on the back of strong price movement, however this shift was mostly attributed to the concentrated top constituents.

The labor market is still strong, but unemployment increased to 4.1%, the highest level since November 2021. The current level is now above the 12-month moving average, a cautionary signal historically. Meanwhile, climbing delinquencies in credit cards, auto loans, and resuming student loan payments could weigh on future consumer spending and GDP growth. The U.S. economy has remained resilient, but cracks are beginning to surface. Services PMI fell below 50 during the quarter and, for the first time in over a year, both services and manufacturing sit below 50, a level that has historically been associated with economic weakness.

EQUITY

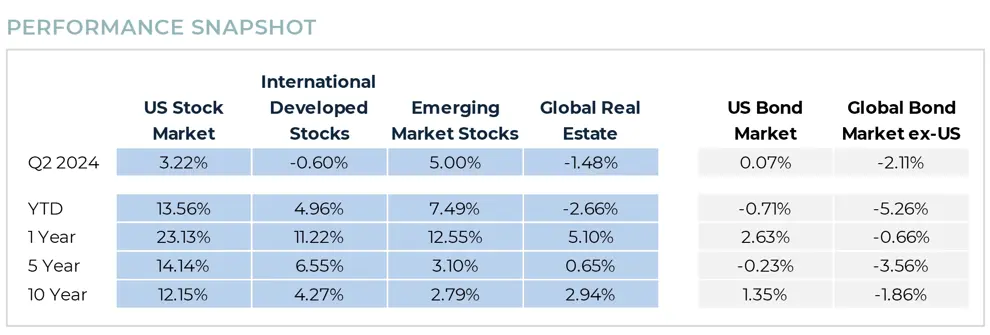

Domestic markets were higher during the quarter as concentrated leadership and hype around artificial intelligence benefitted large cap while small cap struggled to keep pace. Non-U.S. equity markets were negative on increased volatility from divergent central bank policies and election-related risks. Emerging markets increased on positive returns across Asia due to expected rate cuts in India and optimism around economic growth. While earnings growth has been positive, price movement continued to drive multiple expansion. Relative valuations of non-U.S. equity continue to look attractive compared to U.S. markets. The S&P 500 continued its climb with another strong quarter, returning 3.6%. Results were driven by the technology and communications sectors as concentrated leadership remains.

Major economies around the globe saw mixed results during the quarter with the MSCI EAFE returning -0.4% and MSCI EM returning 5.0% during the quarter. Japan had a weak quarter as investors continued to assess whether the BOJ will continue to raise interest rates on mixed inflation and wage data. Uncertainty around economic trends and political elections in Europe moved markets lower. China increased on upbeat inflation data and renewed optimism.

The move higher in interest rates was a broad headwind for the REIT sector, returning 0.1%. Underlying components experienced varied returns. Sectors with longer average lives such as lodging, industrial, and office were the primary detractors.

FIXED INCOME

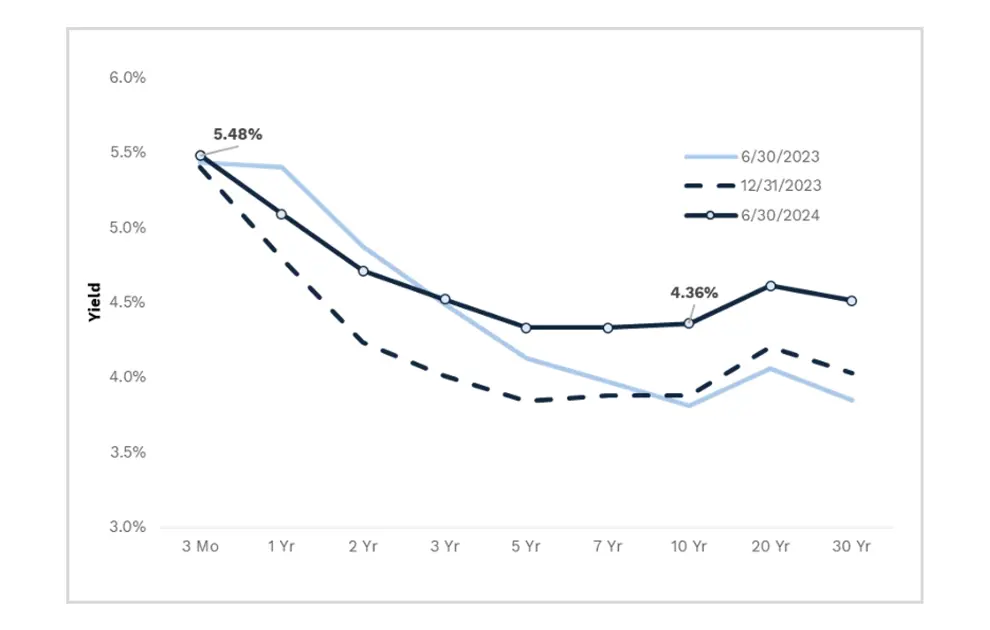

The U.S. yield curve shifted modestly higher during the second quarter as market expectations for the timing of a first Fed rate cut this year waivered. The Fed has indicated there has been further progress made toward its 2% inflation target, but remains data driven on future actions to strike a balance with its dual mandate. The Bloomberg U.S. Aggregate Bond Index added roughly 0.1% in the second quarter.

Less rate-sensitive spread sectors, such as high yield, generally outpaced core markets during the quarter. A resilient economy, favorable corporate fundamentals and strong demand have been supportive of the sector. Foreign bonds fell primarily due to negative currency impact and a strong U.S. Dollar.

Index performance is provided as a benchmark. It is not illustrative of any particular investment. An investment cannot be made in an index. Past performance is not an indication of future results. Russell 3000 Index, MSCI World ex USA Index, MSCI Emerging Markets Index, S&P Global REIT Index, Bloomberg Aggregate Bond Index and Bloomberg Global Aggregate Bond Index ex-US. Returns as of 6/30/2024.

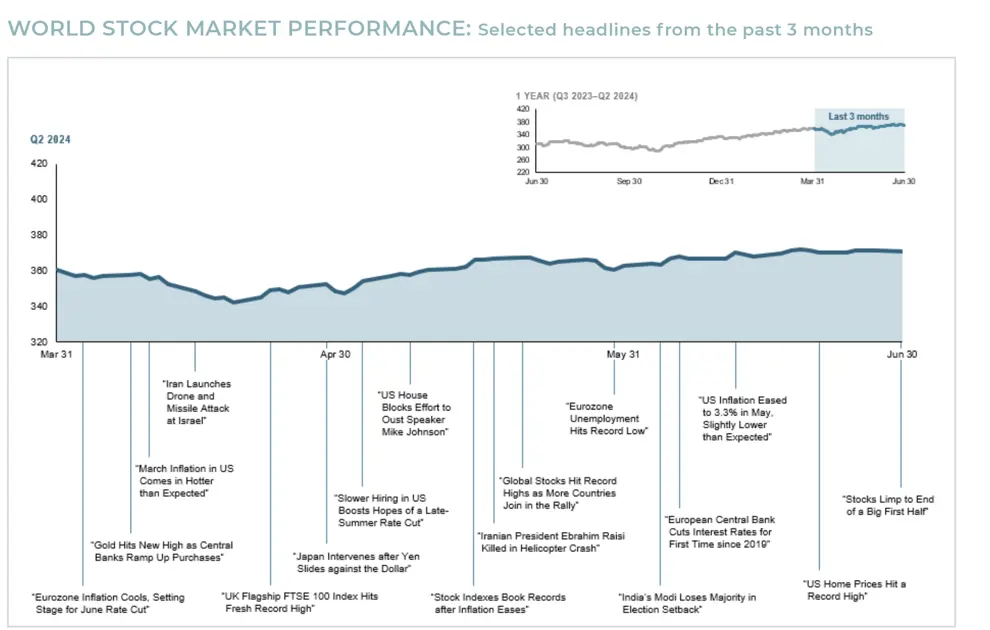

These headlines are not offered to explain market returns. Instead, they serve as a reminder that investors should view daily events from a long-term perspective and avoid making investment decisions based solely on the news.