Third Quarter 2024 - Quarterly Market Update

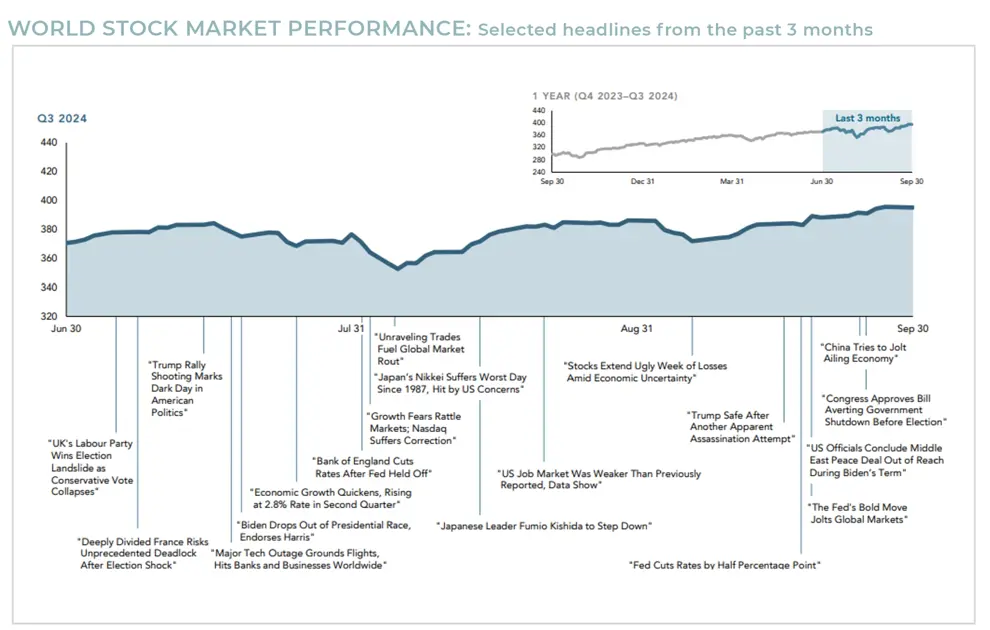

The third quarter was strong for seemingly all investment assets. That said, the current market rally was thrown off course in late early August as investors reacted to a weaker-than-expected jobs report, fueling concerns that a stumbling labor market implied a recession may be looming. After retracing 8.5% by early August, the S&P 500 had just about fully recovered by the end of the month, and subsequently powered to new highs after the Federal Reserve delivered a 50 basis point rate cut (or 0.50%).

The inflation backdrop has continued to progress toward the Fed’s target (U.S. CPI was 2.4% in September) and the labor market has started to show signs of cooling. The duration and extent of future cuts remain uncertain. Overseas, China announced its largest stimulus in nearly a decade while Japanese policymakers adopted a less hawkish tone helping to fuel strong global equity market returns. Market volatility is expected to remain high leading up to the presidential election. Long-term investors who stay invested regardless of political party tend to be rewarded.

EQUITY

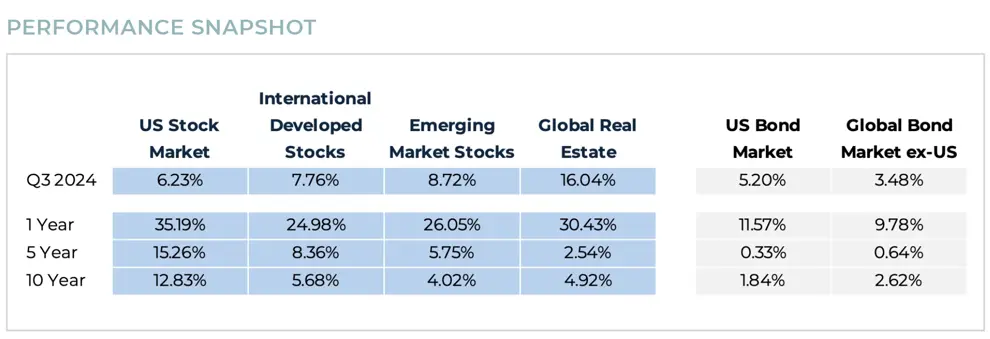

Domestic markets were higher during the quarter as concentrated leadership and hype around artificial intelligence benefitted large cap while lower interest rates propelled small cap stocks. The S&P 500 continued to post new record highs with its fourth consecutive quarterly advance, returning 5.9%. While earnings growth has been positive, price movement continued to drive multiple expansion. Results were driven by the more income centric segments like real estate and utilities as investors sought out attractive yields following a decline in interest rates. The U.S. economy remains resilient growing 3% in the second quarter. Despite some fractures in the labor market, strong corporate fundamentals and a resilient U.S. consumer persist.

Non-U.S. equity markets also produced strong results with emerging markets outperforming its developed peers. Relative valuations of non-U.S. equity continue to look attractive compared to U.S. markets. Major economies around the globe saw strong results during the quarter with the MSCI EAFE returning 7.3% while the MSCI Emerging Markets Index led the way with an 8.7% return. The bulk of the return came in September as China advanced 23.9% on its way to a 23.5% gain during the quarter. Investors cheered additional stimulus and an accommodative rate cut by their central bank.

The move lower in interest rates created a favorable tailwind for the REIT sector, which returned a remarkable 16.0% during the quarter. Longer lease assets benefited the most and the office sub-sector had a strong rebound from depressed levels earlier in the year.

FIXED INCOME

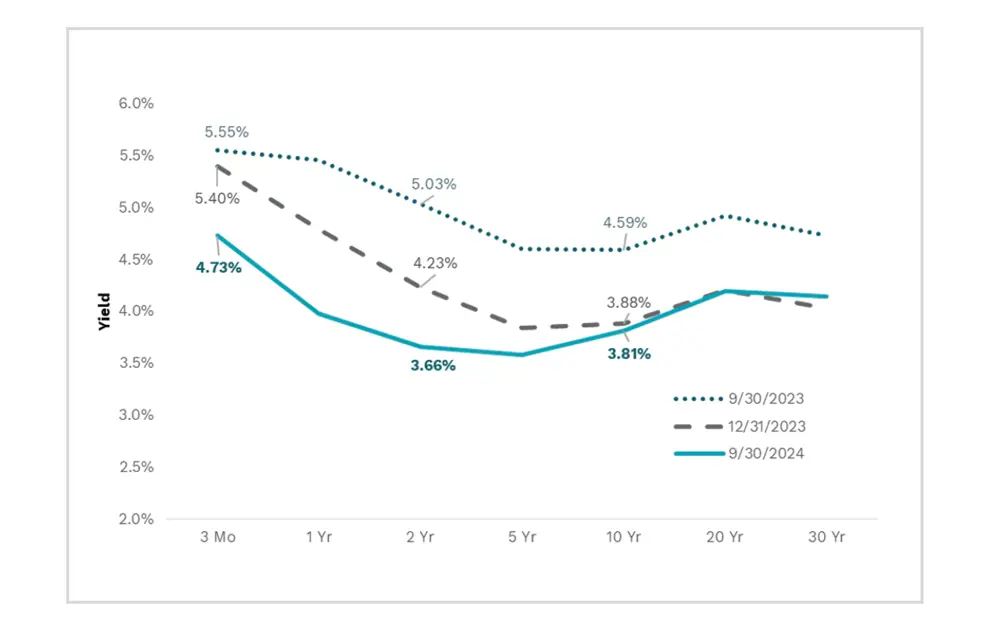

The U.S. yield curve shifted notably lower during the third quarter as the market quickly priced in the first rate cut. In mid-September, the Fed cut its key interest rate by 50 basis points as a flagging job market and lessened inflationary pressures gave room for a shift in policy. The Bloomberg U.S. Aggregate Bond Index added roughly 5.2% in the third quarter.

Less rate-sensitive spread sectors, such as high yield, generally outpaced core markets during the quarter. A resilient economy, favorable corporate fundamentals and strong demand have been supportive of the sector. Foreign bonds produced strong results as the change in monetary policy weakened the U.S. dollar producing a tailwind affect for investors overseas.

Index performance is provided as a benchmark. It is not illustrative of any particular investment. An investment cannot be made in an index. Past performance is not an indication of future results. Russell 3000 Index, MSCI World ex USA Index, MSCI Emerging Markets Index, S&P Global REIT Index, Bloomberg Aggregate Bond Index and Bloomberg Global Aggregate Bond Index ex-US. Returns as of 9/30/2024.

These headlines are not offered to explain market returns. Instead, they serve as a reminder that investors should view daily events from a long-term perspective and avoid making investment decisions based solely on the news.